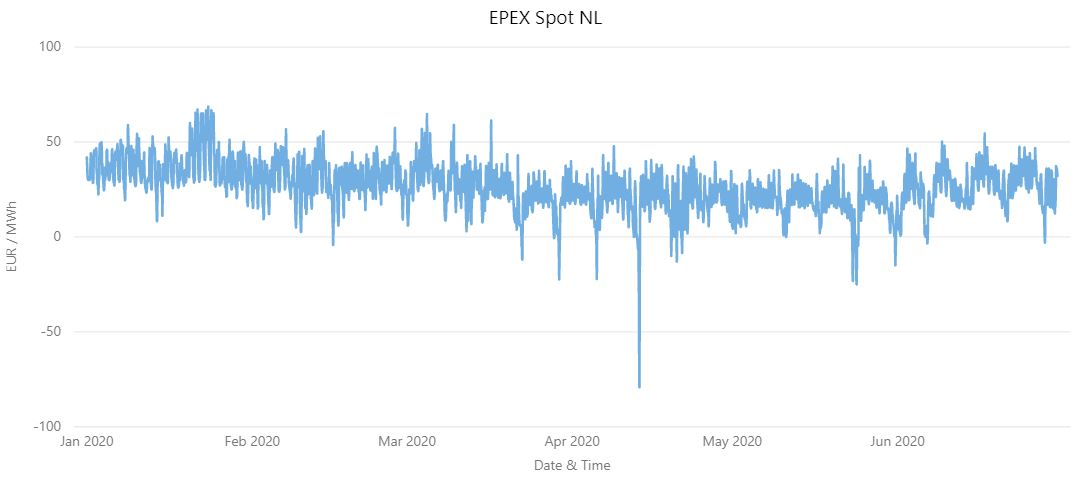

With Covid-19 power demand has come down while power production from renewables assets (wind and solar) is increasing every month. The result of both is that volatility in demand / supply matching has increased substantially leading to negative prices on spot market and increased volatility in balancing markets.

Being exposed to the market price fluctuations on one side and deliver power to end-customers based on fixed price on the other side, creates risk for energy companies that has increased the last few months and has led to financial losses to their supply and hedging activities.

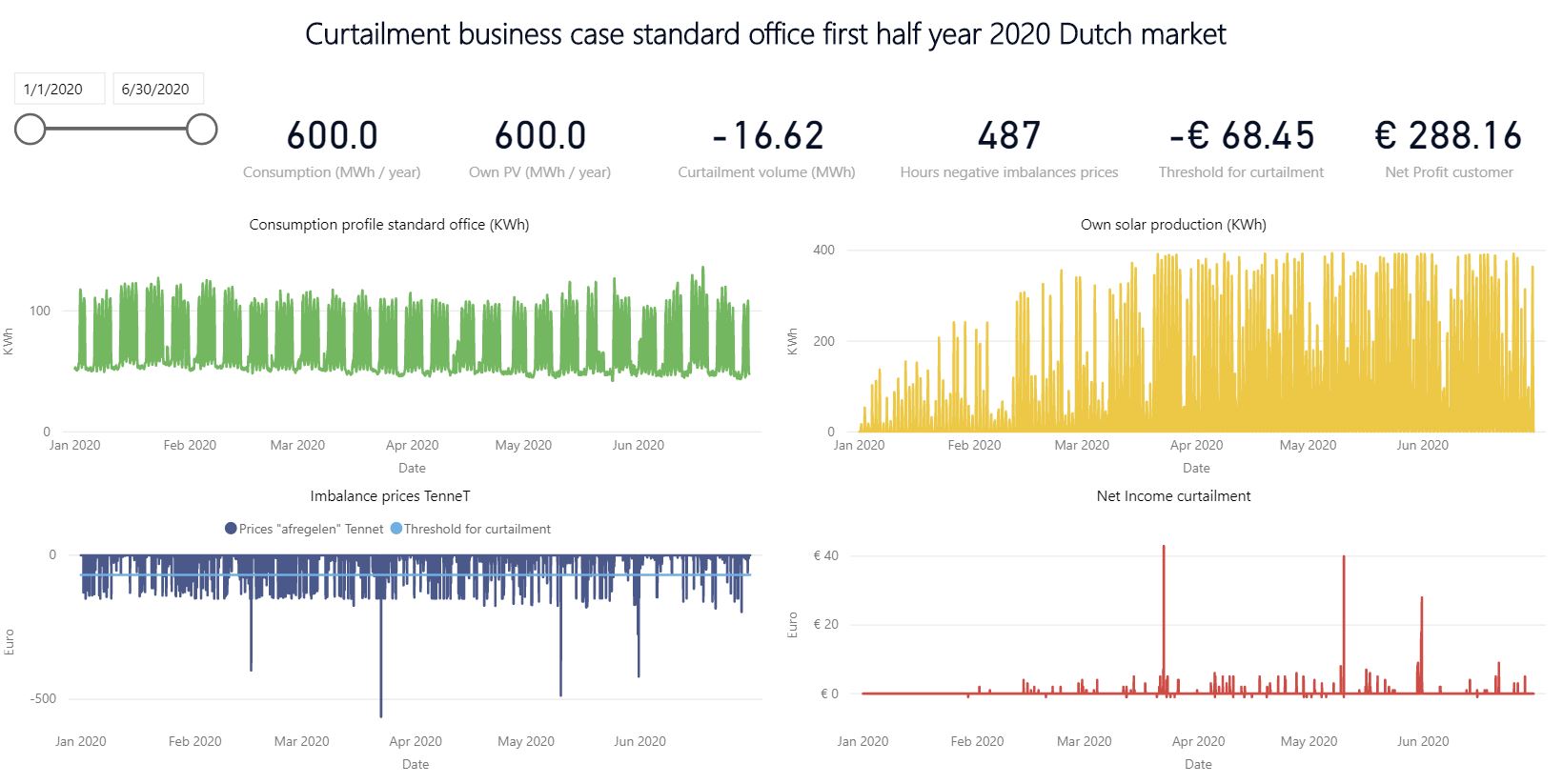

Novitam has developed models and algorithms to optimize solar production against markets using storage facilities on-site or curtailment of production to mitigate risk of delivering power to the grid while prices are negative.